Findings from an innovative study conducted by a team of researchers at Dartmouth’s Geisel School of Medicine and published in the journal Social Science & Medicine are providing new insights into how the rapid spread (or diffusion) of fraudulent Medicare home health care billing has occurred across the U.S. in recent years.

To understand the significant growth of Medicare fraud during the 2000s in just a few regions of the country, the research team examined the network structure of home health agencies (HHAs) and identified a set of characteristics shared by regions where fraud was most likely to occur.

Among their key findings, they determined that these characteristics included the sharing of patients across multiple (and often many) agencies; high rates of expenditures across hospital referral regions (HRRs) and rapid increases in rates over time, substantial growth in the number of HHAs, and whether a region would attract a Department of Justice (DOJ) anti-fraud office. They also found evidence of a peer effect in agency billings, which suggests a sharing of fraudulent practices locally between agencies.

There are currently more than 11,000 HHAs in the U.S. providing care to Medicare beneficiaries—HHAs primarily perform skilled nursing and other medical (therapeutic) services in a patient’s home.

Some common examples of documented fraudulent behavior have included agency owners billing for unnecessary or non-existent services; kickbacks to physicians, patient recruiters, and staffing groups to refer patients to their agency; or sharing of patient IDs across networks of HHAs owned by organized criminal organizations.

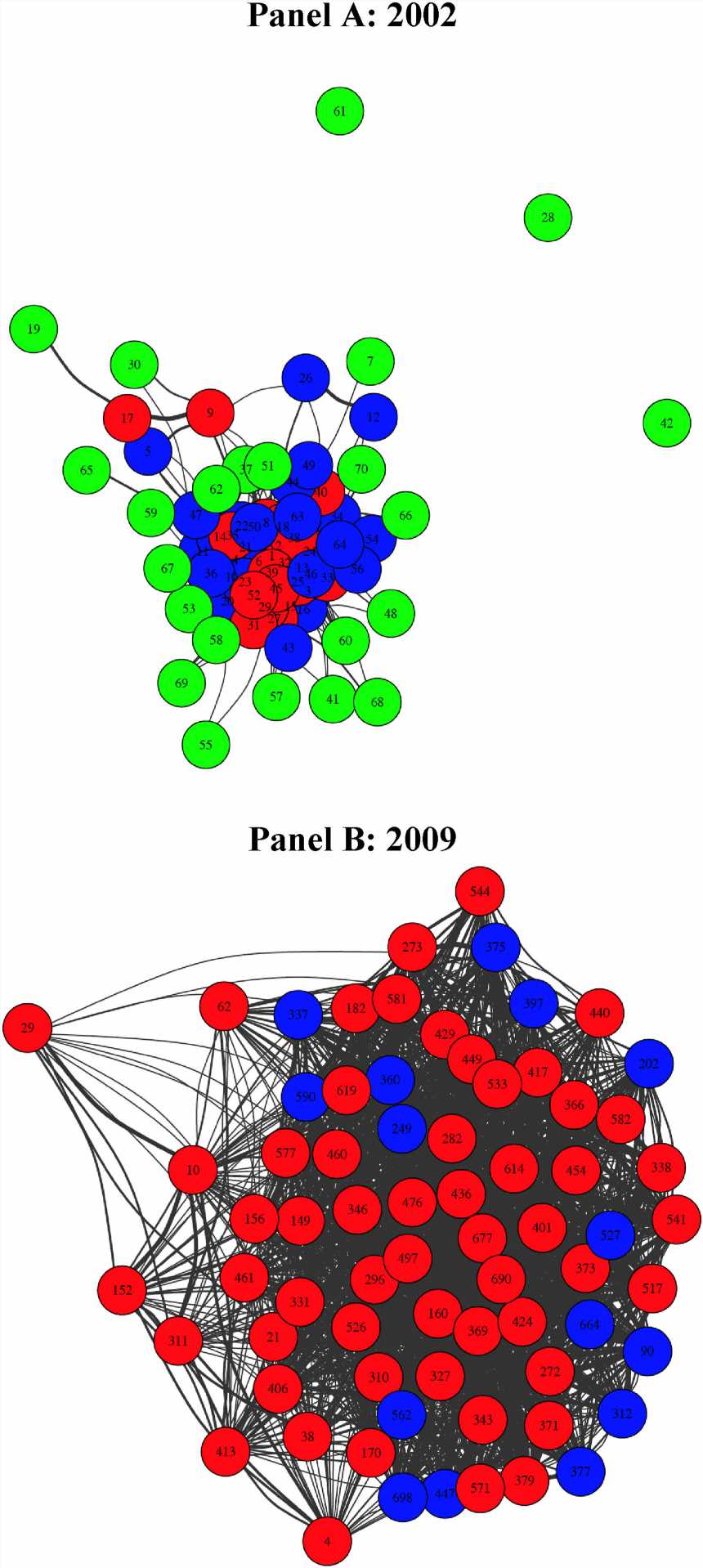

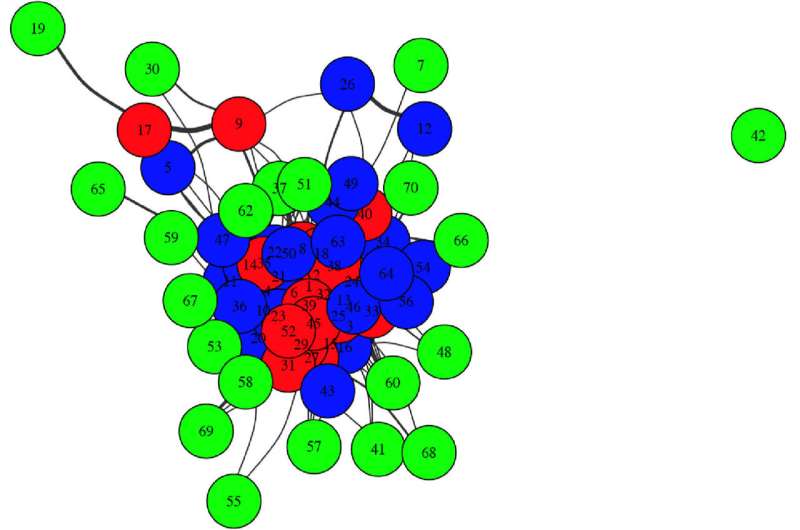

“We developed a novel network analysis tool—a bipartite mixture (BMIX) index—which allowed us to measure the links between each patient and each HHA and gain more information about the diffusion process than was possible using conventional network measures,” explains lead author James O’Malley, MS, Ph.D., who holds the Peggy Y. Thomson Professorship in the Evaluative Clinical Sciences and serves as a professor of The Dartmouth Institute for Health Policy and Clinical Practice and of Biomedical Data Science at Geisel, and adjunct professor in the Departments of Mathematics and Computer Science at Dartmouth.

Using fee-for-service Medicare claims data from the Dartmouth Atlas of Health Care, the study team observed a dramatic increase in home health care activity over a seven-year period (2002 to 2009)—with a more than doubling of expenditures from $14.9 billion to $33.7 billion.

The authors found that the increase in expenditures was highly concentrated in just a few HRRs of the U.S. Lending support to their findings, these regions were also typically the ones where the DOJ subsequently established local anti-fraud offices.

For example, the average billing per Medicare enrollee in McAllen, TX and Miami, FL increased by $2,127 and $2,422 respectively compared to just an average increase of $289 in other HRRs that were not targeted by the DOJ offices. After the first of these anti-fraud offices was opened in Southern Florida in 2007, the DOJ expanded to a total of nine offices by 2016. These areas included: Los Angeles, CA; Tampa, FL; Chicago, IL; Brooklyn, NY; Detroit, MI; Southern Louisiana; and Dallas, TX.

To help explain why the expansion of fraudulent behavior occurred so rapidly in some health care markets but not others, the study team also developed a theoretical economic model. “It more or less makes the argument that if the benefits exceed the risks in the eyes of the perpetrators, then it’s more likely that you’ll see this type of fraudulent behavior—where people are willing to risk conviction, fines, and imprisonment to make larger profits,” O’Malley explains.

One key outcome of the study is that the BMIX index has shown promise in predicting future excessive billing behavior for HHAs, says O’Malley, suggesting its value for machine-learning approaches to unearthing Medicare fraud in HHAs, as well as in other areas of health care.

“We would love for these methods and maybe generalized versions and alternative versions to be used by those persons or organizations who are policing the health care system,” he says. “Hopefully, that would allow them to be able to prosecute more violators of the law, perhaps earlier on before it gets too far out of hand. And that in turn, would then save the health care system and U.S. taxpayers a lot of money.”

O’Malley adds, “This was very much an interdisciplinary paper and I’d like to recognize my two co-authors for their important contributions. Jon Skinner is a wonderful health economist who has been very supportive of what I’ve done in my time here at Dartmouth. And Tom Buboltz is a recently retired, 37-year veteran of The Dartmouth Institute, who has skillfully worked with Medicare claims data throughout his career at Dartmouth.”

More information:

A. James O’Malley et al, The diffusion of health care fraud: A bipartite network analysis, Social Science & Medicine (2023). DOI: 10.1016/j.socscimed.2023.115927

Journal information:

Social Science & Medicine

Source: Read Full Article